Understanding Employee Misclassification

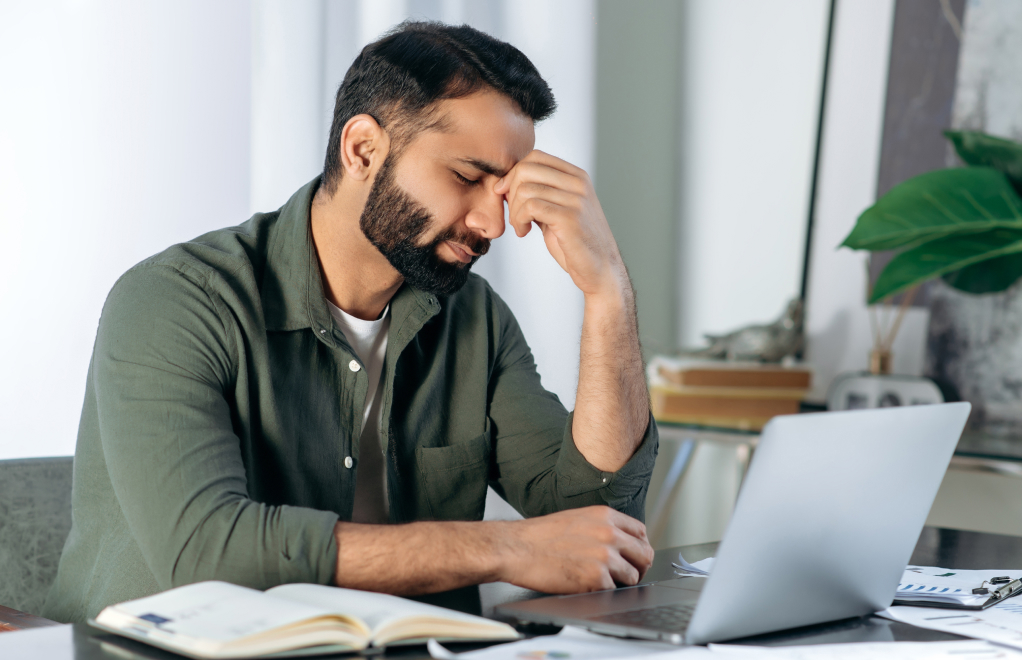

How are you classified at your job? Are you an employee or an independent contractor? Understanding whether you’ve been properly classified at work is essential to protecting your rights as an employee.

Employee misclassification under federal and state law happens when a company labels a worker as an independent contractor or an exempt employee when they should legally be classified as a non-exempt employee. This misclassification can have severe financial and legal consequences — affecting your wages, overtime pay, and access to important benefits. The employer may save money while you lose.

Request Free Consultation

Misclassified Employees May Lose Important Benefits

Misclassified employees with independent contractor status may be taken advantage of by unethical employers. They often miss out on essential protections, including overtime pay, minimum wage protections, health insurance, and workers’ compensation.

For example, labeling a non-exempt worker as “exempt” may allow an employer to avoid paying overtime, while calling an employee an “independent contractor” may wrongfully deny them benefits and job security. These practices can save companies money at the expense of their workers’ rights. If you are actually an employee, you should receive the same benefits as other full-time workers, including if you work overtime, compensation for unpaid rest, and more.

California Labor Law Protects Misclassified Workers

Under California employment laws, employee status is strongly protected against such practices. State and federal laws establish clear tests with several factors — such as the ABC test — to determine whether a worker is truly an independent contractor. If your employer has misclassified you, an experienced employee misclassification attorney can help review your employment status, calculate unpaid wages or overtime, and pursue proper compensation through a claim or lawsuit.

If you suspect you’ve been an employee acting as a contractor, don’t delay. Consult with a knowledgeable employment misclassification lawyer at ARCH Legal. Our skilled employee misclassification attorneys will help you understand your rights and file a complaint to recover the wages and benefits you deserve. ARCH Legal has recovered over $300 million for workers in employment-related litigation.

Employee Classification and Labor Status in California

Proper employee classification is essential to California’s workers’ rights laws. Classification determines a worker’s access to vital benefits and protections such as overtime pay, minimum hourly wage, meal and rest breaks, and other employment benefits. The way a worker is classified — whether as exempt, non-exempt, or an independent contractor — directly affects their legal rights and compensation.

Exempt vs. Non-Exempt Employees

California labor law states that non-exempt employees are entitled to overtime pay, meal and rest breaks, and minimum wage protections. In contrast, exempt employees are typically salaried professionals, executives, or administrative workers who meet specific job duties and salary requirements. Misclassifying a non-exempt employee as exempt allows an employer to avoid paying overtime compensation and can result in significant unpaid wages and labor violations.

Legal Protections Under California Law

The California Labor Code and the Employee Misclassification Act safeguard workers against improper classification. These laws impose penalties on employers who willfully misclassify employees and require them to pay back wages, benefits, and even civil fines. The state also applies the ABC test — a standard from Assembly Bill 5 (AB5) — which presumes workers are employees unless the employer can prove otherwise.

Why Misclassification Happens

Employers may misclassify workers intentionally or negligently to reduce payroll taxes, avoid providing benefits, or sidestep compliance with labor laws. By labeling employees as independent contractors or exempt, companies can cut costs but risk violating state and federal labor statutes.

Impact on Employee Rights and Benefits

Misclassified workers often lose access to unemployment insurance, paid sick leave, family leave, and whistleblower protections. They may also be denied workers’ compensation benefits and job stability. Understanding your classification and seeking legal help can ensure that your rights under California law are protected and that you receive the fair compensation you deserve. Talk to our employee misclassification attorney in a free consultation if you think your employer is misclassifying you.

Exempt Employees and Independent Contractors

Exempt employees are not entitled to overtime pay, meal or rest breaks, or certain wage protections. To qualify as exempt under California law, a worker must meet strict requirements:

- Salary Threshold: The employee must earn a fixed monthly salary of at least twice the state minimum wage for full-time employment.

- Job Duties Test: The employee must primarily perform executive, administrative, or professional duties.

- Independent Judgment: The role must require regular use of discretion and independent judgment in significant work matters.

If an employer fails to meet all three criteria, the worker should be classified as non-exempt and entitled to overtime and other protections.

Risks of Misclassifying Workers as Exempt

Misclassifying an employee as exempt can lead to:

- Unpaid overtime wages for hours worked beyond 8 per day or 40 per week.

- Missed meal and rest breaks, resulting in additional pay owed.

- Lost wages and penalties under California’s wage and hour laws.

Independent Contractor Misclassification

Employers may also misclassify employees as independent contractors to avoid taxes and benefits. Misclassified contractors lose access to:

- Workers’ compensation coverage for on-the-job injuries.

- Unemployment insurance if laid off.

- Paid family and medical leave rights.

- Legal protections such as anti-retaliation and whistleblower laws.

The ABC Test

California’s ABC Test, established under Assembly Bill 5, determines if a worker is an employee or contractor. A worker is presumed to be an employee unless:

A. They are free from the company’s control;

B. Their work is outside the company’s usual business, and

C. They operate an independent business of their own.

Legal Remedies for Misclassified Employees

When employees are misclassified — whether as exempt or as independent contractors — they lose access to essential workplace protections and benefits. Fortunately, California labor law provides strong remedies to help workers recover what they’re owed.

Misclassified employees can pursue legal claims to recover unpaid wages, obtain penalties, and recover compensation for lost benefits. Understanding these rights is the first step toward ensuring fair treatment and financial recovery.

Recovery of Unpaid Wages and Overtime

One of the most common consequences of misclassification is the loss of overtime pay. Non-exempt employees are entitled to overtime wages for all hours worked beyond eight per day or forty per week. Misclassified workers can file claims with the California Labor Commissioner’s Office or through a civil lawsuit to recover unpaid wages, including:

- Overtime pay at 1.5 or 2 times the regular rate.

- Minimum wage differentials, if the salary fell below legal standards.

- Interest on unpaid wages and potential waiting-time penalties for late payments.

Compensation for Missed Breaks and Penalties

California law mandates meal and rest breaks for non-exempt employees. Misclassified workers often lose these rights, resulting in unpaid break premiums. Employees may be entitled to:

- One additional hour of pay for each day a meal or rest break was missed.

- Civil penalties against employers for repeated violations.

- Compensation for retaliation if the employer punished a worker for asserting their rights.

Reimbursement for Lost Benefits and Legal Damages

Misclassification often denies access to crucial employee benefits, including health insurance, retirement contributions, paid leave, and workers’ compensation. Under California labor law, affected workers can seek:

- Reimbursement for lost benefits and out-of-pocket expenses.

- Compensatory and punitive damages in severe cases of willful misclassification.

- Attorneys’ fees and legal costs, ensuring workers can pursue justice without financial burden.

By asserting these rights with the help of an experienced employment attorney, misclassified workers can hold employers accountable and recover the full compensation they deserve. Our employee misclassification lawyers can advise you of your rights if you have been misclassified. ARCH Legal is always ready to go to trial, if necessary, and take on big employers.

Take the Next Steps with ARCH Legal

Don’t let your rights go unprotected. Contact ARCH Legal today for a free, confidential consultation. We’ll guide you through your legal options and help you take the next step toward restoring your fair pay, benefits, and workplace rights. Our attorneys work on a contingency fee basis, and pride themselves as attentive listeners, clear communicators, and powerful legal advocates.

Why Choose ARCH Legal

Employee misclassification can cause serious financial and personal hardships — lost wages, unpaid overtime, missing benefits, and reduced job security. These issues can quickly add up, leaving workers without the compensation and protections they deserve under California law. Because of the statute of limitations, time is critical; waiting too long to take action can limit your ability to recover lost income and damages.

ARCH Legal’s experienced employee misclassification attorneys have a proven track record of helping California workers fight back against unfair labor practices. We thoroughly review your employment status, calculate what you’re owed, and pursue the maximum compensation allowed by law.

Employer Responsibilities and Legal Accountability

California law places a clear duty on employers to properly classify their workers and ensure that all employees receive the wages, benefits, and protections they are entitled to under the California Labor Code.

Employers must distinguish correctly between exempt and non-exempt employees and between employees and independent contractors. Failing to do so can result in substantial legal and financial consequences. Proper classification ensures that workers receive overtime pay, meal and rest breaks, health insurance, and other employment benefits required by law.

Penalties for Intentional Misclassification

Under California Labor Code Section 226.8, employers who willfully misclassify employees face serious penalties. Intentional misclassification—defined as knowingly labeling an employee as an independent contractor to avoid legal obligations—can lead to:

- Civil penalties range from $5,000 to $25,000 per violation.

- Public posting requirements require employers to acknowledge and correct violations.

- Additional fines for unpaid wages and benefits owed to misclassified workers.

Employer Liability for Violations

Employers found liable for misclassification may be required to pay:

- Unpaid wages and overtime for all hours worked.

- Rest and meal break compensation.

- Reimbursement for lost benefits and damages.

- Attorney’s fees and court costs if legal action is necessary.

These penalties serve as a strong deterrent against cutting costs through illegal labor practices.

Importance of Accurate Employment Records

California employers are legally required to maintain accurate records of employees’ hours, wages, and classification status. Inaccurate or missing records often strengthen an employee’s claim during a dispute.

Statutory Deadlines for Legal Action

Workers must act promptly to protect their rights. The statute of limitations for wage claims in California is generally three years, but may extend to four years for violations under unfair competition laws. Timely legal action, with your employment misclassification attorney’s help, ensures you can recover the full compensation and penalties owed under state law.

Protecting Employee Rights Through Legal Action

Both California and federal labor laws guarantee workers like you the right to fair pay, proper benefits, and safe working conditions. When these rights are violated through misclassification or wage theft, you have legal avenues to seek justice and financial recovery.

Retaliation Is Also Illegal

Workers are also protected from retaliation for reporting labor violations or filing a misclassification complaint. Employers cannot legally fire, demote, or harass employees for standing up for their rights under the California Labor Code and the Fair Labor Standards Act (FLSA).

Misclassification Lawyers Can Pursue Your Unpaid Wages and Benefits

An experienced employee misclassification attorney at our law office can help by evaluating your job duties and pay structure, identifying misclassification, and pursuing claims for unpaid wages, overtime, meal and rest break penalties, and lost benefits. Legal representatives also handle Private Attorneys General Act (PAGA) claims and lawsuits to hold employers accountable for systematic labor violations.

ARCH Legal makes legal support accessible through free consultations and contingency fee arrangements, meaning you pay no upfront fees — our employment attorneys only collect payment if they successfully recover compensation on your behalf.

Taking legal action not only helps you reclaim what you are owed but also strengthens workplace fairness and ensures that employers across California comply with state and federal labor laws.

Frequently Asked Questions

How do I know if I’ve been misclassified as an independent contractor?

You may be misclassified if your employer controls how, when, and where you work, even though you’re labeled as an independent contractor. Key indicators include being required to follow specific schedules, using company tools, or performing work essential to the business.

True independent contractors typically control their own work, negotiate rates, and serve multiple clients. The “ABC test” used in many states, including California, presumes worker status unless the employer proves you’re free from control, perform work outside the business’s usual course, and operate an independent trade.

What rights do misclassified employees lose?

Misclassified workers lose significant employee rights and protections. These include minimum wage, overtime pay, meal and rest breaks, workers’ compensation, unemployment insurance, and employer-paid payroll taxes. They may also miss out on health benefits, retirement plans, and protections against discrimination or wrongful termination. Because they’re labeled as contractors, they often bear tax burdens that employers should pay. Misclassification can also affect eligibility for family leave and disability benefits.

Can I recover unpaid overtime and benefits if I was misclassified?

Yes. If you were wrongly classified as an independent contractor, you can file a claim to recover unpaid overtime, minimum wage differences, and the value of lost benefits. Remedies may include back pay, unpaid taxes, meal and rest break premiums, and reimbursement for business expenses. Federal and state labor agencies, such as the U.S. Department of Labor or California Labor Commissioner’s Office, can investigate your claim. You may also pursue a civil lawsuit seeking damages and penalties.

How long do I have to file an employee misclassification claim?

The time limit — known as the statute of limitations — varies by jurisdiction and type of claim. Under federal law (FLSA), you generally have two years to file for unpaid wages, or three years if the violation was willful. In California, wage-related claims must typically be filed within three years, extending to four years if you pursue a claim under unfair competition laws. Claims involving benefits or tax violations may have different deadlines. It’s best to act quickly, as the clock usually starts when the misclassification or unpaid wages occurred.

Can my employer retaliate against me for challenging my worker classification?

No. Retaliation for asserting your legal rights is illegal. Employers cannot fire, demote, threaten, or harass you for questioning your classification or filing a claim. Both federal and state labor laws protect workers who report misclassification, wage theft, or related violations. If retaliation occurs, you can file a separate complaint for damages, reinstatement, and penalties. In California, Labor Code §98.6 specifically prohibits such actions and allows recovery of lost wages and additional compensation. Keeping documentation — emails, texts, or witness accounts —strengthens your case.

What industries most commonly face employee misclassification issues?

Industries with flexible or gig-based work often face high misclassification rates. Common examples include construction, trucking, janitorial services, home healthcare, entertainment, and technology—especially gig platforms like rideshare or delivery companies. Freelancers and subcontractors in creative fields such as media, design, and photography also encounter this issue. Employers in these sectors sometimes classify workers as independent contractors to cut costs on taxes, insurance, and benefits.

What is the penalty for misclassification of employees in California?

California imposes strict penalties for willful misclassification. Employers may face civil fines ranging from $5,000 to $25,000 per violation under Labor Code §226.8, especially for misclassifying most exempt employees . Additional liabilities include back wages, unpaid overtime, tax penalties, and reimbursement for denied benefits. The state may also require the employer to publicly post a notice acknowledging the violation. Repeat or intentional offenders can face enhanced fines and business license consequences. Beyond state penalties, federal agencies like the IRS or Department of Labor can impose their own sanctions.

What are two things that can happen if there is a misclassification of a worker?

First, the employer can face serious legal and financial consequences, including back pay, tax liabilities, fines, and penalties for violating wage and hour laws. They may also be required to reclassify workers and provide proper benefits. Second, the worker loses essential employee rights—such as overtime pay, unemployment insurance, and health coverage — leading to personal financial harm. Misclassification can also trigger audits by labor agencies and the IRS, damaging the employer’s reputation.

How to report independent contractor misclassification?

If you believe you’ve been misclassified, you can file a complaint with your state labor agency or the U.S. Department of Labor’s Wage and Hour Division. In California, report to the Labor Commissioner’s Office using their online or paper claim forms. Provide evidence, such as work schedules, pay stubs, job descriptions, and communications, that demonstrate employer control. You may also file a Form SS-8 with the IRS to determine your correct classification for tax purposes. Retain all documentation and consider consulting an employment attorney.

What is the statute of limitations for misclassification in California?

In California, the statute of limitations for misclassification-related wage claims is generally 3 years under Labor Code § 1194. However, if the claim involves unfair business practices—such as systemic misclassification — it can extend to four years under the Business and Professions Code §17200. Claims for unpaid overtime, minimum wage, and missed breaks follow the same timelines. If tax issues are involved, federal or state tax agencies may have separate deadlines. Because each case differs, consulting an employment attorney early ensures timely filing.

Our acknowledgement

Have you suffered harassment or discrimination in the workplace?

Find The Right Attorney For Your Case

Contact ARCH Legal today to speak with an experienced employment law attorney dedicated to protecting your workplace rights. Whether you’re facing discrimination, retaliation, or wage violations, our team is ready to help. Call, email, or schedule a free consultation to discuss your case and explore your legal options.